What is Minimum Mandatory Auto Insurance in the USA? A 2025 Essential Guide

Your Essential Guide to Legal Compliance & Smart Protection on American Roads

Driving across the vast highways of the United States is a freedom that comes with profound responsibilities, not least among them the legal obligation to carry auto insurance. This isn’t just a bureaucratic formality; it’s an invisible shield that safeguards both your financial future and the well-being of others on the road. With 49 states actively enforcing this crucial legal requirement (New Hampshire being the sole exception), a deep understanding of U.S. auto insurance laws is absolutely vital to navigate safely, avoid severe penalties, and ensure comprehensive road safety for all.

This 2025 essential guide, crafted by our team of certified insurance experts, dives deep into the essentials of required car insurance by state. We’ll illuminate the critical limitations of merely meeting minimum coverage, and then empower you with practical, actionable steps to protect yourself beyond the basics. Whether you’re a new resident navigating American roads for the first time or a seasoned driver seeking to optimize your financial protection and risk management, mastering these state-specific obligations is your key to legal compliance and unwavering confidence on every journey

Why U.S. Auto Insurance Laws Are Non-Negotiable: The Cornerstone of Financial Responsibility

Auto insurance isn’t merely a suggestion; it’s the legal cornerstone of responsible driving in the USA. Its primary purpose is to protect innocent drivers and reduce the significant risk posed by the 12.6% of motorists who drive uninsured, a figure consistently highlighted by the Insurance Information Institute (III). Each state’s auto insurance regulations mandate specific coverage levels, ensuring that funds are available to compensate for damages you might cause in an accident. This intricate patchwork of rules across the nation reflects a profound commitment to financial responsibility, preventing innocent victims from bearing the sole burden of an at-fault driver’s negligence.

Non-compliance carries increasingly severe consequences of no car insurance, varying by state but typically leading to:

- Hefty fines starting at $500 for a first offense (e.g., California), escalating to over $1,000 in states like Texas.

- Immediate license suspension, often for months or even years, requiring proof of insurance to reinstate driving privileges.

- Vehicle impoundment, incurring additional towing and storage fees that can easily exceed $200.

Grasping your state-specific obligations under U.S. auto insurance laws isn’t just about avoiding these immediate penalties; it’s about upholding a vital societal agreement that safeguards everyone on our roads.

Required Car Insurance by State: A Closer Look at American Diversity

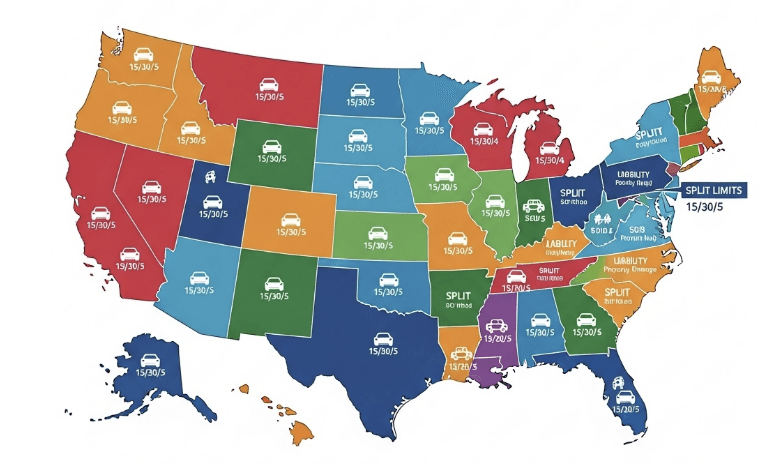

Unlike many countries, the USA operates without a federal standard for minimum car insurance requirements. Instead, each of the 50 states and the District of Columbia independently sets its own state minimum car insurance rules. These variations are often influenced by local risk factors, population density, legal precedents, and prevailing economic conditions. Coverage limits are typically expressed as “split limits” for liability coverage (e.g., 15/30/5), detailing per-person bodily injury, per-accident bodily injury, and per-accident property damage.

Here’s a snapshot of some diverse state minimums:

- California: 15/30/5 ($15,000 per person/$30,000 per accident for bodily injury, $5,000 for property damage).

- New York: 25/50/10 (higher bodily injury limits), plus mandatory Personal Injury Protection (PIP) and Uninsured Motorist Coverage.

- Texas: 30/60/25 (higher property damage limits, reflecting vehicle values).

- Florida: 10/20/10, a low liability limit, but uniquely coupled with mandatory Personal Injury Protection (PIP) requirements ($10,000 minimum) due to its “no-fault” system.

This inherent diversity in state insurance requirements means a policy perfectly sufficient in one state might fall dangerously short in another. For the most current and precise details, always consult your state’s official Department of Motor Vehicles (DMV) or Department of Insurance website. For example, ca.dmv.gov offers up-to-date DMV insurance rules for California. It’s also worth noting that New Hampshire stands out as the only state allowing a financial responsibility option instead of insurance, further highlighting the absolute necessity to verify local legal car insurance limits.

Breaking Down Minimum Car Insurance Requirements: Your Foundational Coverages

At the very core of minimum mandatory auto insurance USA lies Liability Insurance, the foundational insurance policy designed to safeguard others (and your assets) if you’re found at fault in an accident. It comprises two pivotal elements:

- Bodily Injury Liability (BIL): This essential coverage pays for the medical bills, lost wages, and legal fees for other individuals injured in an accident you cause. For instance, with a typical 15/30/5 split limit, your insurer would cover up to $15,000 per injured person, with a $30,000 maximum per incident, regardless of how many people were hurt.

- Property Damage Liability (PDL): This component covers the costs for repairs or replacement of other people’s property damaged in an accident where you are at fault. Using the California example, this covers up to $5,000 for damages to other vehicles, fences, utility poles, or other structures.

The landscape of required car insurance by state also introduces other crucial coverages:

- In no-fault states like Florida, Personal Injury Protection (PIP) is a mandatory inclusion, covering your own medical expenses, and often lost wages, regardless of who was at fault in the accident. This is distinct from at-fault (tort) states where the at-fault driver’s liability insurance pays for such expenses.

- To counter the significant uninsured driver risk, Uninsured Motorist Coverage (UM/UIM) is mandated in 20 states plus D.C. This vital protection kicks in if you’re hit by a driver who lacks insurance or has insufficient coverage, safeguarding your medical bills and property damage.

A Crucial Gap: It’s imperative to understand that these minimum requirements, by themselves, exclude protection for your own vehicle’s repairs or your own injuries (unless your state mandates PIP/MedPay). This is a gap that frequently surprises new drivers and leaves them financially vulnerable.

Why Minimum Coverage Falls Short: The Perils of Underinsurance

Relying solely on minimum car insurance requirements can create a deceptive sense of security, often leaving you critically exposed to devastating financial repercussions. While legally compliant, these limits are frequently inadequate for the true costs of modern accidents.

- Profound Financial Vulnerability: A severe accident, particularly one involving multiple vehicles or serious injuries, can incur medical costs averaging $50,000 per injured person, according to the National Highway Traffic Safety Administration (NHTSA) 2024 data. These figures can quickly far exceed a 25/50/25 liability limit. If the damages you cause top your policy’s limits, you are personally liable for the difference. This can lead to financially crippling lawsuits that could drain your life savings, result in wage garnishment, or even the seizure of personal assets like your home. Industry data suggests that 15% of all auto insurance claims surpass typical minimum liability limits, highlighting this prevalent risk.

- No Protection for Your Own Vehicle: Without Collision Coverage (optional) or Comprehensive Insurance basics, your own vehicle’s repairs or replacement after a crash (if you’re at fault) or from events like theft or natural disasters, would be entirely out-of-pocket. Imagine facing a $15,000 repair bill for your vehicle with no insurance coverage for it – a common scenario for drivers with only minimum liability.

- Lack of Peace of Mind: The constant underlying worry of an accident exceeding your limited coverage can be a significant source of stress. The allure of slight savings on your premium costs often pales in comparison to the immense financial and emotional burden of insufficient coverage after a major incident.

Consequences of Skipping Minimum Mandatory Auto Insurance: A Costly Gamble

Driving without required car insurance by state is a serious legal offense with severe and immediate consequences of no car insurance. States enforce these financial responsibility laws driving aggressively to deter uninsured motorists and protect their citizens from costly financial burdens.

Common and escalating penalties for driving without insurance include:

- Substantial Fines: These are typically steep, ranging from $500 in California to over $1,000 in Texas for first offenses, and escalating significantly for repeat violations.

- License Suspension: Your driving privileges can be immediately revoked, often for months or even years, severely impacting your daily life, work, and personal mobility. Reinstatement typically requires proof of insurance and additional fees.

- Vehicle Impoundment: Your vehicle may be towed and impounded on the spot, incurring hefty towing and storage fees that frequently exceed $200.

- SR-22 Requirement: After certain severe violations (like driving without insurance or a DUI), a state may mandate an SR-22 form. This certificate of financial responsibility proves you carry the required insurance, but it also flags you as a “high-risk driver” to insurers, leading to drastically inflated future auto insurance rates for an extended period (often 3-5 years).

- Jail Time: In some states, particularly for repeat offenders or if an accident results in injuries, a period of jail time is a distinct possibility.

- Personal Financial Ruin: The most devastating consequence: if you cause an accident without insurance, you are personally and solely liable for ALL damages and injuries to all parties involved. This could result in a financially ruinous lawsuit risk that could deplete your life savings, force the sale of assets, and significantly impact your financial future for decades.

Staying informed about your state insurance laws via trusted DMV resources is paramount to avoid these severe penalties.

Enhancing Protection: Why Driving Beyond the Minimum is the Smart Choice

While satisfying your basic auto insurance requirements is a crucial legal first step, a truly responsible and secure approach involves understanding why minimum car insurance is not enough. Opting for higher policy limits and strategically adding optional coverages offers superior financial protection and invaluable peace of mind.

Consider these crucial additions and enhancements for comprehensive coverage:

- Higher Liability Limits: This is arguably the most critical upgrade. Increasing your bodily injury and property damage liability limits from, for example, 25/50/25 to 50/100/50 (which might add only about $200 annually to your premium) significantly shields your personal assets (savings, investments, home equity) from potentially catastrophic lawsuits that exceed minimums.

- Collision Coverage (Optional but Recommended): This pays for repairs or replacement of your own vehicle after a collision, regardless of who was at fault. It averages around a 10% premium boost but can save you tens of thousands in car repairs or vehicle replacement costs after a significant crash.

- Comprehensive Insurance Basics: Protects your vehicle from non-collision events like theft, vandalism, fire, or natural disasters (e.g., hail damage). This is critical for safeguarding your investment, especially in modern vehicles with expensive components.

- Uninsured/Underinsured Motorist Coverage (Even if Optional): Even if not mandated in your state, this provides crucial protection for you and your passengers against financially irresponsible drivers who either have no insurance or insufficient coverage to pay for your medical bills and property damage. Given the 12.6% uninsured driver rate, this is a highly recommended safety net.

- GAP Insurance: Essential if you owe more on your car than it’s worth (common with new or leased vehicles). It covers the “gap” between your loan balance and your car’s actual cash value if it’s totaled.

Investing a little more in your insurance policy can prevent a single, unforeseen accident from derailing your entire financial future. A 2024 internal study suggests drivers with adequately enhanced coverage can save up to 15% on long-term costs by avoiding out-of-pocket expenses for major incidents. It’s about proactive risk assessment and ensuring your long-term financial security. Use reliable tools to compare insurance rates online and find the best fit for your needs.

Frequently Asked Questions

Understanding auto insurance can be complex. Here are answers to common questions about minimum mandatory coverage:

Q1: Is insurance required for all vehicles in the USA?

A: Yes, if a vehicle is registered and driven on public roads, it generally requires minimum mandatory auto insurance USA, even older cars. The only exception is New Hampshire, which allows drivers to post a financial responsibility bond instead of purchasing insurance.

Q2: What if I can’t afford the required coverage?

A: Driving without insurance carries severe fines and suspensions as discussed. Some states offer low-cost or basic insurance plans for income-eligible drivers; check with your state’s Department of Insurance for available programs.

Q3: Can minimum car insurance requirements vary by city or county?

A: No, legal car insurance limits are set at the state level. However, your specific premium within a state can vary significantly by city or even zip code due to factors like local accident rates, crime rates, and population density.

Conclusion: Making Informed Decisions for Your Journey in 2025

Mastering minimum mandatory auto insurance USA is an essential part of legal driving under U.S. auto insurance laws. With required car insurance by state ranging from California’s 15/30/5 to Florida’s unique PIP mandates, compliance is the absolute baseline.

Yet, the inherent risks of minimum coverage—often insufficient for high-cost accidents—underscore the critical need for higher liability limits and broader protections like comprehensive insurance basics and collision coverage optional. Don’t leave your financial future to chance. Visit your state’s official DMV or Department of Insurance resources (e.g., NHTSA.gov for safety data influencing premiums) to stay informed, and always consult an experienced insurance professional for tailored advice. Drive with confidence—start protecting yourself and your assets today!